Navigating the Challenges: Shipping Routes Amidst Panama Canal Disruptions

Shipping companies today grapple with significant disruptions. Both the Suez Canal and the Panama Canal face unprecedented challenges – including recent geopolitical tensions, combined with severe environmental conditions – which have forced many of the world’s largest shipping companies to reconsider their routes.

Towards the end of last year, geopolitical instability in the Middle East escalated with attacks on Israeli shipping in the Red Sea. In response, leading shipping companies like Maersk, MSC, Hapag Lloyd, Evergreen, and BP have opted to divert ships around the Cape of Good Hope, South Africa, favouring this longer route over the increasingly perilous Suez Canal.

Meanwhile, the Panama Canal, a critical artery for global maritime trade, is suffering from the most severe drought in its history due to the “El Niño” phenomenon. This involves a warming of the sea surface temperature, which occurs every few years and can alter weather conditions – disrupting shipping routes.

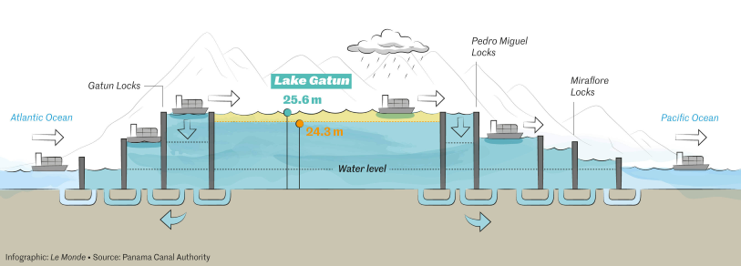

The Panama Canal is an engineering marvel that sees ships transporting $270 billion worth of cargo annually across Gatun, a man-made lake situated 26 meters above sea level. The canal features locks at both ends, where vessels are elevated from the ocean onto the lake at one end and lowered back to sea level at the other. Each transit through the canal and its locks consumes an average of 52 million gallons of freshwater.

However, the canal’s water levels are now at their second lowest in its 110-year history. Recent times have seen a shortage of rainfall, preventing the lake from being replenished as it usually would be. The lack of sufficient rainfall in the Gatun and Alajuela Lakes, which supply the canal with its essential water, has drastically reduced the number of vessel transits. Since November 2023, the Panama Canal Authority has progressively cut daily transits from 36 to 24, with ships also asked to carry less cargo. However, recent rains have allowed an increase to 27 vessels per day.

This reduction is significant, given that the Panama Canal is one of the busiest shipping routes in the world. An average of 14,000 vessels transit the route annually, representing about 6% of global maritime trade volumes. The canal’s reduced capacity has had a ripple effect; increasing transit times, costs and risks associated with maritime transport.

Many major shipping lines, including MSC, CMA CGM, and Hapag Lloyd, have implemented surcharges for services transiting the canal, while Maersk has chosen to divert some of its cargo to rail services across Panama.

The Impact on Shipping and Commercial Clients

The challenges faced by the Panama Canal have far-reaching implications for shipping companies and their commercial clients. The cost to cross the canal has risen due to the reduced number of transit slots as well as the implementation of additional water-saving measures – significantly increasing the operational expenses for ship owners and operators.

Additionally, the reduction in available transit slots has led to extended waiting times for vessels, which disrupts shipping schedules and further inflates operational costs.

These disruptions have forced many vessels to take longer routes to avoid the Suez Canal, leading to increased travel times. Longer journeys inherently raise the likelihood of incidents, thereby elevating the risk for insurers and underwriters.

The impact on cargo volumes has also been profound. As of January 2024, there has been a 33.4% reduction in the number of transits and a 46.6% decrease in cargo volume compared to the previous year, hampering the shipping industry’s capacity to move goods efficiently.

Furthermore, shipping companies have had to make significant operational adjustments. Many vessels are now rerouted, resulting in longer and more costly journeys. This has necessitated new logistics and supply chain strategies to adapt to the changing circumstances. Despite these challenges, the Panama Canal Authority has assured the industry that it will maintain a maximum draught of up to 44 feet (13.41 meters) to keep the route competitive. However, NeoPanamax vessels have been particularly affected, experiencing a greater drop in transits compared to Panamax vessels.

Alternative Solutions For Shipping Companies

Due to the recent rainfalls in Panama, the Panama Canal has now increased the number of daily transits from 27 to 32 vessels under the schedule below:

- From 16 to 31 May, the daily transit slots to 7 Neopanamax vessels and 24 Panama vessels, with a total of 31 daily transits.

- From 1 June, an additional Neopanamax daily transit will be allowed, to a total of 32 daily transits.

Additionally, the maximum vessel’s draught will be increased after June 15 to 13.71m (54 feet) for Neopanamax vessels and to 13.41m (44 feet) for Panama vessels. These numbers are almost at the pre-crisis levels of 36 vessels per day and officials seem to be optimistic.

In the interim, alternative transport routes such as “land canals” combining port terminals, highways, and railroads in Central and South America have become vital. Several container lines utilised these infrastructures in 2023 and 2024 to mitigate the impact of the Panama Canal’s restrictions.

Although we could see the return of normal transit volumes soon, we should expect to witness more permanent changes to the operations.

Logistics Must Be Pre-Planned

During the crisis, needing to allocate fewer transit slots, the Panama Canal Authority (ACP) shifted from a first-come, first-served model to a booking system, auctioning off unused slots. Before the current crisis, approximately 70% of transits were booked in advance. The authority plans to permanently increase this share after reopening to further enhance the canal’s reliability.

A daily auction process might become a lasting feature of the crisis, with slots potentially being allocated five to seven days in advance. During the crisis, limited availability saw a single transit slot auctioned for $4 million, excluding a canal toll of $500,000, resulting in a 50% increase in round-trip costs for transporting LNG, according to S&P Global analysts.

Anyone moving goods between the east coast of the Americas and Asia or Oceania, are urged to be watchful of the situation, as the El Niño phenomenon – which heats up the Eastern Pacific Ocean – has become an increasingly challenging factor, according to the canal authority. This comes alongside rainfall continuing to shift from areas the canal was designed to capture.

The construction of a new reservoir would be a viable solution, providing longer-term security for the maritime sector, although construction will demand support from both government and local communities. We will certainly hear more about this in the future.

Your Dedicated Marine Consultancy

The maritime industry remains resilient, continuously adapting to these evolving challenges. At ABL, we stay committed to supporting our clients through these turbulent times, leveraging our expertise to navigate the complexities of global shipping routes. Our experienced local team in Panama are regularly assisting our global clients navigate the challenging environment with their expert local insights.

ABL brings together the deepest pool of multi-disciplinary expertise to support all areas of shipping. Our services include:

Technical Due Diligence & Advisory

We help our clients to make the right business decisions. By acting as your trusted advisor, we’ll ensure you understand the limitations and opportunities involved as early as possible.

International Shipping Consultancy

With over 150 years of legacy in the industry, we can work with you on a wide range of multi-disciplinary projects across all areas of shipping.

Marine Surveys, Inspections and Audits

ABL Group are world-leading providers in all types of marine surveys, inspections and audits, providing rapid marine assurance and risk support to clients anywhere in the world, and catering to vessels and offshore assets of any type and any size to help you to minimise risk and keep your operations on track.

Marine Design, Upgrade & Conversion

We can bring market-leading expertise in naval architecture to our clients, and will support to find the optimal solution for your assets or project.

Expert Witness & Litigation Support

In the instance where things go wrong, we can support on a wide range of claims or disputes across the marine sector. We work with legal firms, P&I Clubs, finance houses and banks, oil majors, vessel owners and managers, and regulatory bodies to bring technical support and cutting-edge technology to their specific situation.

Our extensive footprint across the Americas, with offices in Rio de Janeiro, Mexico City, Tampico, Panama, San Francisco, New Orleans Boston, Fort Lauderdale, Houston, New York, Seattle, Vancouver, Calgary and Halifax, provides clients with the most pragmatic on the ground expertise, supported by our global teams – making us a true global partner and local expert.

Get in touch with our Panama office to learn more about how we can help you to navigate commercial shipping route disruptions.

By Jose Alberto Rosas Rodrigues

Country Lead, ABL Panama