Annual Report 2021

AqualisBraemar LOC ASA Annual Report 2021 is attached and can now be downloaded from our Reports and Presentations page.

The Annual report 2021 is also available in the European Single Electronic Format (ESEF).

AqualisBraemar LOC ASA Annual Report 2021 is attached and can now be downloaded from our Reports and Presentations page.

The Annual report 2021 is also available in the European Single Electronic Format (ESEF).

FINANCIAL YEAR 2022

31.08.2022 – Half-yearly Report

29.04.2022 – Annual Report

01.06.2022 – Annual General Meeting

29.04.2022 – Quarterly Report – Q1

28.10.2022 – Quarterly Report – Q3

Change of date for AGM from June 2nd to June 1st 2022

This information is published pursuant to the requirements set out in the

Continuing obligations.

Reuben Segal, CEO of AqualisBraemar LOC ASA (“AqualisBraemar LOC”, “ABL Group” or the “Company”) commented:

“For the first quarter, we are pleased to report our highest quarterly revenue, operating profit and operating cash flow to date. We are seeing high and increasing activity across all our market sectors, resulting in improved staff utilisation and pricing power.

Revenues grew 8% year-on-year, primarily driven by continued high growth in our renewables consultancy OWC, which grew 56% compared to the same quarter last year. Investments made in recruitment, new business areas and high bid submission activity through 2021 are starting to pay off, enabling high activity in what is normally a seasonally weaker quarter for renewables.

These results represent the highest operating margin in a first quarter in the Company’s history. While the Middle East and Asia Pacific remain our strongest performers in terms of profitability, we see improvements across all segments relative to the last quarter. Synergies from the LOC acquisition, of which we have now realised USD 3.4 million of our USD 4.0 million target on a run rate basis, have contributed to the margin increase and we expect the remainder of these synergies to be realised during 2022.

Our market outlook remains upbeat, as an increased focus on energy security is expected to lead to increased demand for our services across renewables and oil and gas. This increased activity is likely to result in rate and cost inflation, and we remain focused on staying ahead of the curve as the market develops.”

A presentation of the quarterly results will be held today at 08:15 CET at SpareBank 1 Markets’ office at Olav Vs gate 5, 0161 Oslo. The event will be webcasted live and available for replay shortly after. To watch the webcast and download the presentation, please visit our Reports and Presentations page.

CrossWind, the joint venture between Shell and Eneco, has appointed international energy and marine consultancy ABL Group to support the construction of the Hollandse Kust Noord offshore wind farm.

ABL’s operations in the Netherlands, working closely with the company’s offices in Aberdeen and London in the UK, has been appointed to provide Marine Warranty Survey (MWS) services for the offshore transportation and installation (T&I) of the wind turbines, with a view to putting the first turbine in the water by 2023.

The scope of work also includes MWS of T&I operations relating to the inter array cables.

“The Hollandse Kust Noord offshore wind farm will have a big impact on the offshore wind energy market. With CrossWind and partners actively involved with R&D to identify innovation and renewable technology clustering to maximise efficiency, this is a great project to be involved in. We are excited to get started.”

Jetze-Dirk Spijksma, Project Manager at ABL’s Dutch operations

The 759MW Hollandse Kust Noord offshore wind farm will be located 18.5 kilometres off the coast of the North-Holland province. It will consist of 69 wind turbines of 11MW, situated mostly over 1 kilometre from each other, and installed at around 15-28 metres water depth.

ABL Group has an extensive track-record of supporting the Dutch offshore wind market, contributing to more than ten projects with a combined capacity of more than 4GW. This includes roles as owner’s engineer, independent engineering consultant, geotechnical engineer and MWS.

ABL is part of Oslo-listed AqualisBraemar LOC ASA.

AqualisBraemar LOC ASA (“ABL”) will release its first-quarter results on Friday, 29 April 2022 at approximately 06:00 Central European Time (CET).

A presentation of the quarterly results will be held the same day at 08:15 CET at SpareBank 1 Markets’ office at Olav Vs gate 5, 0161 Oslo. The event will be webcast live and available for replay shortly after. To watch the webcast, please visit our Reports and Presentations page.

The earnings release concerning the quarterly results and a corresponding slide presentation will be posted on www.newsweb.no and on our Reports and Presentations page.

25 February 2022 – AqualisBraemar LOC’s 2021 fourth-quarter results

Reuben Segal, CEO of AqualisBraemar LOC ASA (“AqualisBraemar LOC”, “ABL” or the “Company”) commented:

“2021 has been an eventful year for the Company. The acquisition of LOC Group, completed just before the start of the year, meant we doubled in size for the second time in less than two years. I am impressed and proud of the way our employees from both groups have welcomed their new colleagues, and how seamlessly the two organisations have gelled together. The integration of two equally strong organisations across 39 countries will always be a challenging task, and it was certainly not made easier by the travel restrictions in place for most of the year. I want to direct a heartfelt thanks to our employees for their dedication and efforts in dealing with the integration and other challenges caused by the pandemic. As omicron-related restrictions are now lifting in many of our operating areas, we look forward to seeing our colleagues more in person in the year to come, while taking advantage the improved efficiencies and learning points from the last two unprecedented years.

In addition to the LOC transaction, we carried out three other acquisitions during the year: East Point Geo, a geoscience consultancy delivering services primarily to renewables, OSD-IMT, a ship design consultancy with more than 150 designs launched to date, and finally the remaining shareholding in Innosea, our renewables engineering, design and R&D consultancy. These additions have strengthened ABL’s capabilities in key strategic areas, supporting further growth within renewables and engineering specifically.

In 2020 we set a group-wide target of 50% renewables and sustainability-oriented services in our business mix by 2025. This was an ambitious target, but with 53% revenue growth in renewables during 2021, we are well on our way there: Renewables now make up 27% of our total group revenues. We also opened three new renewables hubs during the year, in Ireland, France and Brazil, and started three new renewables business areas with key senior hires within onshore wind, battery storage and hydrogen. While these growth investments and higher than normal bid submission activity lowered margins in our renewables business during the fourth quarter, we are already seeing the benefit and expect them to support continued high growth in 2022.

Within oil & gas and maritime, we are now seeing green shoots after another year of curtailed activity amid pandemic restrictions and limited investment budgets. While rig activity and brownfield activities have been stronger since the summer, we are now seeing signs of more greenfield investments, and we expect this to drive significant order intake in 2022. Given the capex investments and sanctioning activity now signalled by oil companies, and the reduced capacity in the market after years of low investments, we expect rates in this market to increase in the coming years.

Finally, we are happy to announce that the Board has proposed another dividend increase to NOK 0.3 per share, as part of our semi-annual dividend schedule. Our shareholders have repeatedly supported us in connection with the major acquisitions over the last few years, and we remain focused on repaying that trust by returning capital to shareholders.”

A presentation of the quarterly results will be held today at 08:45 CET at SpareBank 1 Markets’ office at Olav Vs gate 5, 0161 Oslo. The event will be webcasted live and available for replay shortly after. To watch the webcast and download the report and presentation, please visit our Reports and Presentations page.

AqualisBraemar LOC ASA (“ABL”) will release its fourth-quarter results on Friday, 25 February 2022 at approximately 06:00 Central European Time (CET).

A presentation of the quarterly results will be held the same day at 08:45 CET at SpareBank 1 Markets’ office at Olav Vs gate 5, 0161 Oslo. The event will be webcasted live and available for replay shortly after. To watch the webcast, please visit our Reports and Presentations page.

The earnings release concerning the fourth quarter 2021 results, the quarterly report and a corresponding slide presentation will be posted on www.newsweb.no and on our Reports and Presentations page.

FINANCIAL YEAR 2021

25.02.2022 – Quarterly Report – Q4

FINANCIAL YEAR 2022

31.08.2022 – Half-yearly Report

29.04.2022 – Annual Report

02.06.2022 – Annual General Meeting

29.04.2022 – Quarterly Report – Q1

28.10.2022 – Quarterly Report – Q3

This information is published pursuant to the requirements set out in the Continuing obligations.

AqualisBraemar LOC Group (ABL Group) has acquired the remaining 29 percent stake in Innosea – a leading engineering, design and R&D consulting firm specialising in marine renewables – increasing its total shareholding to 100 percent.

“We are delighted to take full ownership of Innosea. The company is rapidly growing and has proven to be a vital part of our service offering to the renewables sector. We have an ambition that 50 percent of our group’s revenues should come from sustainability and energy transition services by 2025. Innosea will play a key part in this.”

David Wells, CEO of AqualisBraemar LOC

Innosea was founded by Hakim Mouslim, Bruno Borgarino and 3 other researchers in 2012, as a technology spin-off from Ecole Centrale de Nantes. Today, the company has offices in Nantes and Marseille in France as well as in Edinburgh, Scotland.

Innosea is one of the few independent specialists in Integrated analysis of fixed and floating offshore wind turbines. Further, the company offers design and engineering consultancy to all marine renewable energies – wind, solar, wave and tidal – with a large track-record of multi-national R&D, demonstration and commercial projects that are at the cutting edge of technology and device development. Innosea is also the leading engineering consultancy for floating solar PV with more than 90 projects worldwide.

“Becoming fully owned by AqualisBraemar LOC marks a continuity of the integration and cooperation with all of the group’s global office network and competence base. This allows us to provide wider and stronger support to our clients, which in turn translates to more rapid expansion of activities.”

Hakim Mouslim, Managing Director and Co-Founder of Innosea

AqualisBraemar LOC group today employs more than 900 people in 39 countries worldwide. The group operates in the renewables sectors through the Innosea, OWC, AqualisBraemar LOC, Longitude and East Point Geo brands.

“We are already collaborating with some of our sister companies and have identified a matching culture with a robust approach to technical excellence and client delivery. It is great to be part of a group that is dedicated to driving a responsible energy transition, and we are keen to develop an additional set of services around climate change adaptation and resilience of offshore and maritime assets.”

Bruno Borgarino, CTO and Co-Founder of Innosea

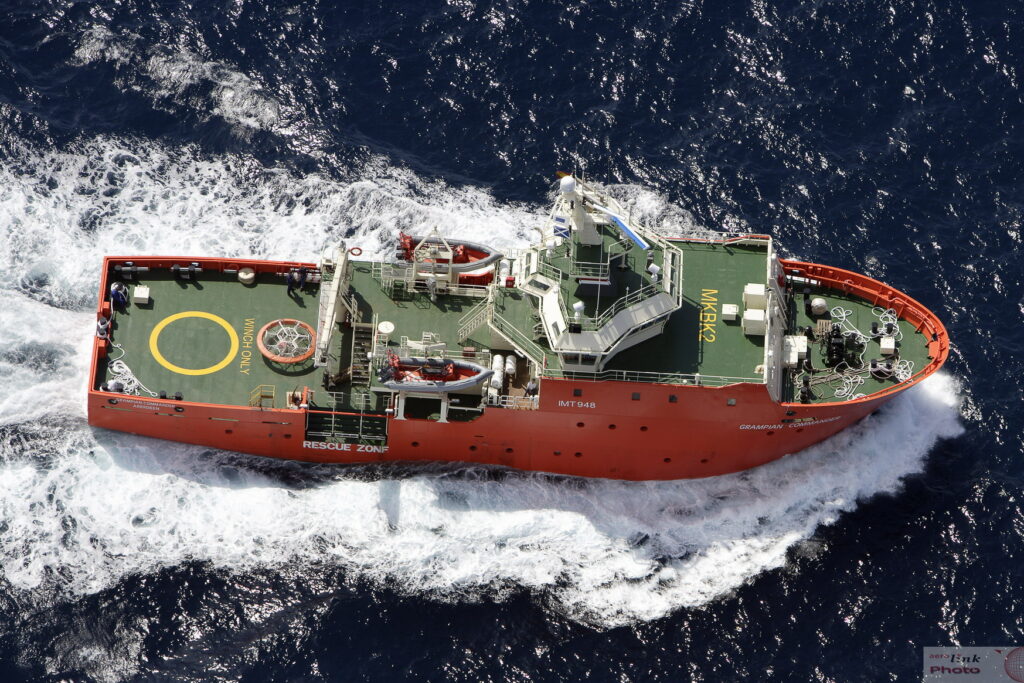

Energy and marine consultancy AqualisBraemar LOC Group (ABL Group) has successfully completed the acquisition of the UK operations of ship design and marine consultancy company OSD-IMT, from Damen Shipyard Group.

OSD-IMT is a specialist consultancy in ship design for newbuild, refit and conversion projects. The company operates in all key marine markets – including the renewables, maritime, defence and oil and gas sectors. Its expert knowledge covers a broad selection of vessel types and a wide range of technologies, including design and engineering for alternative fuels. The company in particular specialises in newbuild construction, support and supply vessels for the offshore energy industry, dredger and dredging support vessels, and marine survey vessels.

OSD-IMT, which has launched more than 150 designs to date, will become part of ABL Group company Longitude Engineering, which specialises in marine operations engineering and marine design, conversion and upgrade of specialised vessels. Further, Longitude has a solid track-record in the design and development of clean shipping technology, with experience in hybrid-propulsion, LNG and hydrogen fueled-vessels.

“Our plan is to combine OSD-IMT’s ship design track record with Longitude’s specialist expertise in marine design, consultancy and operations. While OSD-IMT have traditionally focused more on newbuild ship design, Longitude’s legacy is rooted in specialist consultancy services including advanced analysis, hybrid power systems and procurement support. The combination is an excellent match.”

Jake Anderson, Group MD for Engineering Services at ABL Group and Managing Director of Longitude Engineering

“With maritime decarbonisation accelerating into focus, bringing together OSD-IMT and Longitude’s portfolios in alternative fuel-powered vessel design, will significantly reinforce our offering to support a wide range of maritime stakeholders on the path to net-zero.”

Dean Goves, Managing Director Maritime, Longitude Engineering

Longitude Engineering specialises in independent engineering, design and analysis for renewables, maritime, defence, oil and gas and infrastructure market sectors. It primarily supports clients with marine operations engineering and marine design, conversion and upgrade, supporting marine projects and assets throughout their development lifecycle.

Find out more by visiting the OSD-IMT Website: https://www.osd-imt.com/